In conversations about inequality, we often hear about income gaps, job access, or geographic privilege. But beneath all of this lies a quieter, more insidious divide, a gap not of money itself, but of knowledge about money. This is the financial literacy gap: the most invisible, and arguably the most destructive, wealth divider of our time.

A Problem Bigger Than It Appears

Over 3.5 billion adults worldwide lack basic financial knowledge. This isn’t speculation. According to the Standard & Poor’s Global Financial Literacy Survey, only 33% of adults globally are considered financially literate. That means two out of every three people you pass on the street likely don’t fully understand how interest works, what inflation does to their savings, or how to diversify risk in a portfolio.

The situation becomes even more concerning when we zoom in on the youth. A 2020 OECD PISA study revealed that one in five 15-year-olds in developed nations lacks the basic proficiency to make simple financial decisions. This is occurring in parallel with rising digital adoption: 62% of these students already have a payment card, and over 85% are making purchases online.

We have created an economy where people can transact before they can understand what they’re transacting in. That’s not innovation. That’s a systemic failure.

Misguided Entry into Adulthood

The implications of financial illiteracy are not abstract. They manifest tangibly in the lives of young adults who are forced into financial adulthood without the tools to navigate it. Most students graduate knowing how to analyze Shakespeare or solve for X, but cannot read a bank statement, understand interest compounding, or identify predatory loan structures.

This lack of preparation leads to common, costly mistakes. Credit cards become traps, not tools. Investment is viewed as gambling. Budgeting becomes a reactive act of scarcity management instead of a proactive tool for wealth creation. Even high earners fall into the illusion of financial health, mistaking income for stability.

What starts as a lack of knowledge evolves into a cycle of missed opportunities, chronic stress, and long-term wealth suppression.

Access is not the same as Understanding

In the last decade, fintech has exploded. From no-fee brokerages to personal finance apps, we’ve made markets and money more accessible than ever before. But here lies a dangerous assumption: that access equals understanding.

A user can download five investment apps, open a crypto wallet, and set up auto-debit on a budgeting tool, and still have no idea what they’re doing. The financial tools designed to empower are often layered with complexity that even professionals struggle to parse.

What we’ve done is give people the keys to a race car without teaching them how to drive. And when they crash, we blame them instead of questioning the system.

The Institutional Disparity

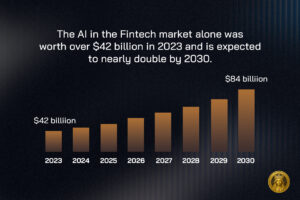

This isn’t just a personal issue. It is systemic. While retail users operate in fragmented apps and learn from trial-and-error, institutions run multi-billion-dollar portfolios using AI, machine learning, and algorithmic insights.

Hedge funds use predictive modeling to optimize risk and return in milliseconds. Meanwhile, the average retail investor is watching YouTube videos to understand what a P/E ratio means.

The knowledge tools of the powerful are hidden behind gated platforms, professional licensing, or high-net-worth barriers. The rest are left with speculation, noise, and oversimplified tools that gamify the market but don’t educate.

This imbalance is not just unfair. It is mathematically deterministic. When two groups play the same game with different tools, the outcome is already written.

Rewriting the Script: A New Learning Model

Solving the financial literacy gap is not about teaching more courses or handing out PDFs. It requires a shift in how learning is experienced. Information alone is insufficient. Engagement, personalization, and practice matter more.

This is where new models like “Learn to Earn” come in. At the forefront is LadyFoxx, a platform purpose-built to create financially empowered individuals by bridging the gap between knowledge and application.

Rather than dumping content, LadyFoxx introduces users to a sandbox environment where they can experiment with simulated capital. Through guided AI mentorship, real-time feedback, and a reward system powered by blockchain ($LDFX), users can practice financial decision-making in a safe, gamified ecosystem.

The focus is not just on content retention but also on behavior change. The journey moves from:

- Learning basic concepts

- Practicing decisions in a risk-free space

- Earning rewards for performance

- Progressing toward real-world investing with AI support

This model doesn’t just teach finance. It builds confidence. And in a world where fear often dictates financial inaction, confidence is the real currency.

Financial Literacy is Financial Power

Wealth doesn’t grow just from saving more or spending less. It grows from knowing how to move, allocate, protect, and compound capital over time. All of that starts with literacy. Yet we treat financial education like an afterthought. It’s rarely a requirement in schools, taught in homes, and often introduced too late, once people are already in debt or making high-stakes financial decisions.

That has to change.

In the same way that reading and math were democratized through public education in the industrial age, financial literacy must be reimagined for the digital era. It must be personalized, experiential, and as intuitive as the platforms it seeks to explain.

A Generation on the Brink of Empowerment

The good news? There is an entire generation eager to learn. Gen Z and young millennials are digitally fluent, data-driven, and disillusioned with traditional finance. They want tools that speak their language and meet them where they are.

Platforms like LadyFoxx aren’t building apps. They’re building bridges. Between ignorance and knowledge. Between passive users and empowered actors. Between systemic exclusion and financial independence.

The future of finance will be intelligent, transparent, and borderless. But only if the people using it are equipped to thrive within it.

Closing the literacy gap is not a side mission. It is the mission. Because once people understand money, they stop being controlled by it. They begin to control it. And in that moment, the wealth gap doesn’t just shrink. It transforms.

get in touchLet’s connect. Your financial glow-up starts here.

Got questions? Ideas? Big goals? Let’s talk money, AI, and everything in between.

Resources

How to buy LDFX

Audit Report

Other Links

How to buy LDFX

Audit Report